#Tax

Politicians, Taxes, and Your Vanishing Paycheck

#Tax

Politicians, Taxes, and Your Vanishing Paycheck

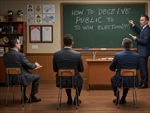

Ah, taxes—the magical process where the government takes your money, spends half of it figuring out how to spend the other half, and then tells you they need more. Politicians, those ever-charismatic tightrope walkers of public trust, promise tax cuts while approving pay raises for themselves. Meanwhile, the government, an all-knowing entity with the efficiency of a sloth on vacation, assures you that your hard-earned dollars are being put to good use—like funding studies on why pigeons bob their heads. And when you dare question it? Well, that’s just unpatriotic.

Stamp Duty Rates to Rise: Brits Must Act Before April 1 Deadline

- Wednesday, 02 April 2025

Stamp Duty Land Tax (SDLT) is a tax paid on property or land purchases in England and Northern Ireland, effective April 1. The current zero percent threshold will drop from £250,000 to £125,000, while the first-time buyer's threshold will revert to £300,000. The rates for properties worth less than £250,000 will increase from 0% to 2%, with higher rates applying to more expensive purchases. Additionally, an extra 5% surcharge will apply on top of existing rates when buying a second property or a share in a house.